aurora co sales tax rate

The December 2020 total local sales tax rate was also 5500. The December 2020 total local sales tax rate was also 5500.

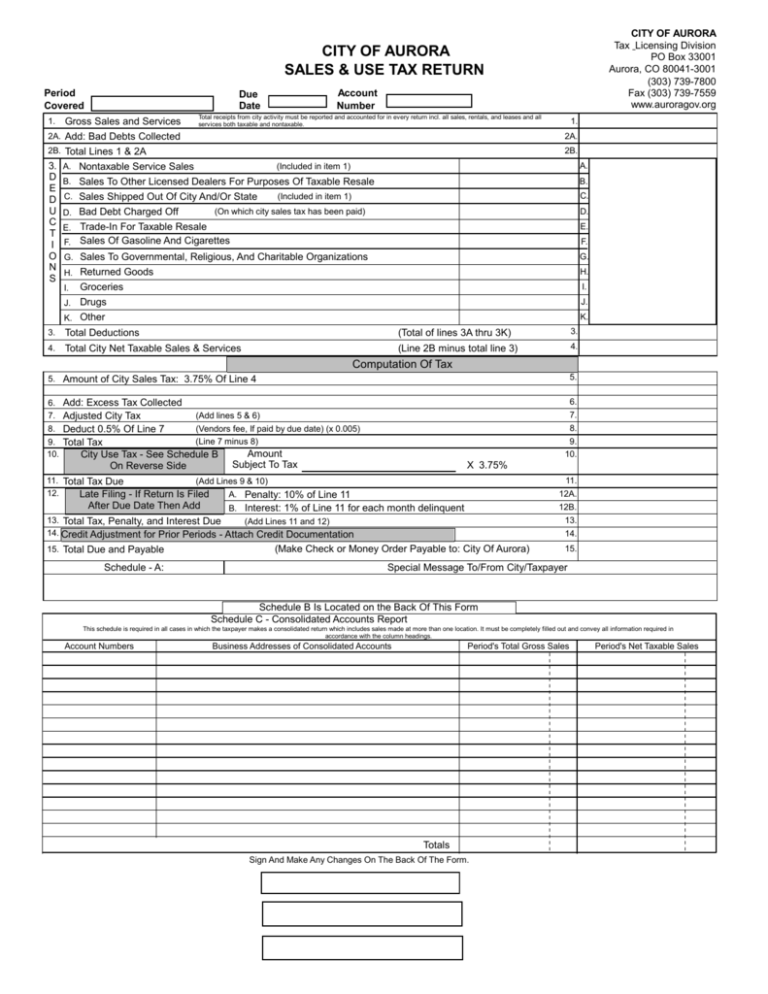

The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city.

. In general there are three steps to real estate taxation namely. The December 2020 total local sales tax rate was 8350. The current total local sales tax rate in Aurora SD is 5500.

There are approximately 213758 people living in the. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora. The current total local sales tax rate in Aurora OH is 7000.

The December 2020 total local sales tax rate was also 8000. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income tax deduction. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

Annually if taxable sales are 4800 or less per year if the tax is less than. The latest sales tax rates for cities in Colorado CO state. Combined Marijuana Tax Rate Including Sales Tax Rate Excise.

An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80012 80014 and 80019. The December 2020 total local sales tax rate was 7250. Aurora Sales Tax Rates for 2022.

What is the sales tax rate in Aurora Colorado. Creating tax levies evaluating property worth and then receiving the tax. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. Rates include state county and city taxes. Aurora Colorado 80012 3037397800 ARAPAHOE COUNTY.

The minimum combined 2022 sales tax rate for Aurora Colorado is. The current total local sales tax rate in Aurora MO is 8850. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city. The current total local sales tax rate in Aurora NE is 5500. The current total local sales tax rate in Aurora OR is 0000.

The current total local sales tax rate in Aurora CO is 8000. The December 2020 total local sales tax rate was also 0000. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county.

Special Event Tax Return. Under state law the government of Aurora public.

What Is Subject To Sales Tax What Is Excluded In Washington State Asp

The Lawrence County Missouri Local Sales Tax Rate Is A Minimum Of 6 725

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Expert Advice For Moving To Aurora Co 2022 Relocation Guide

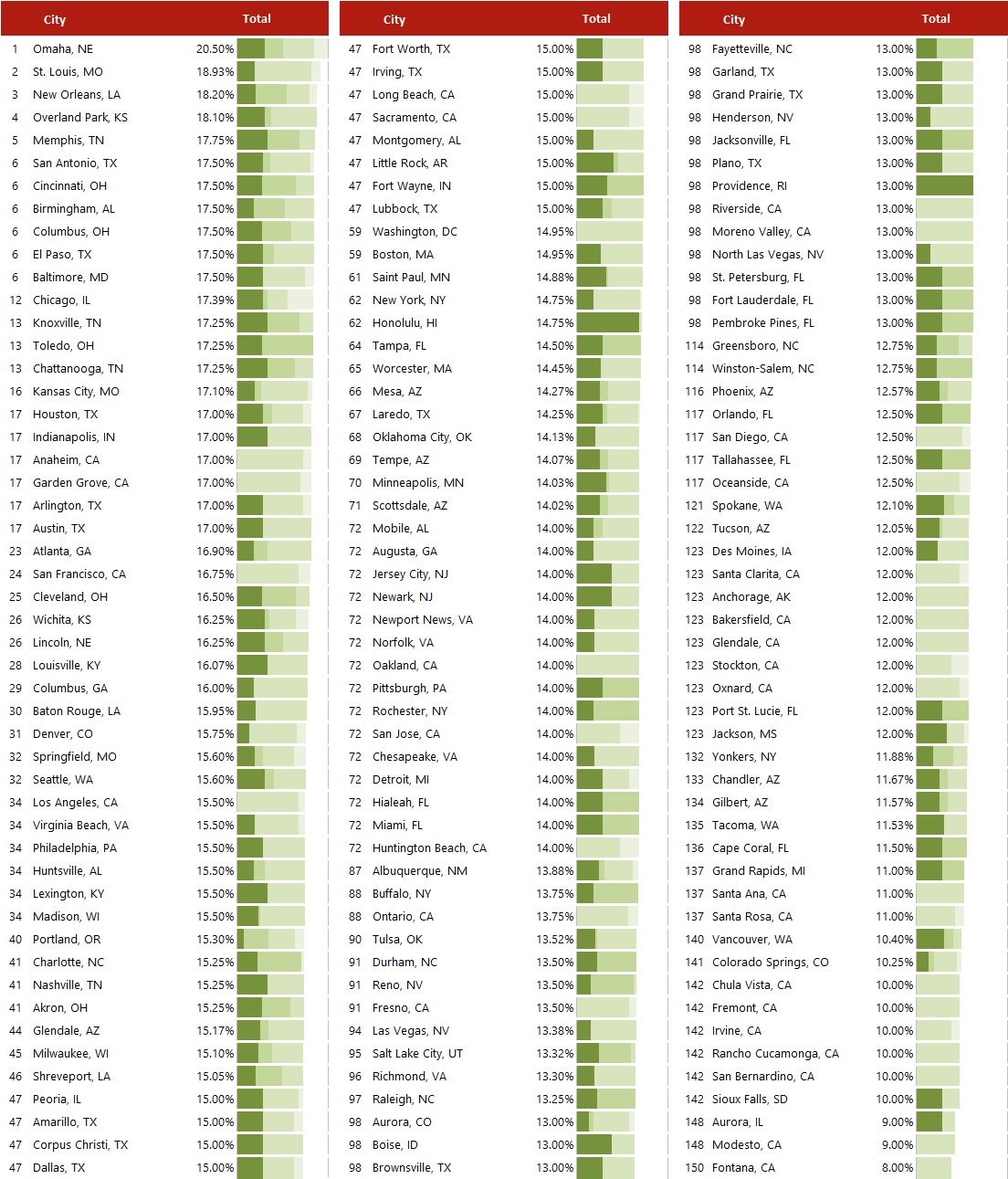

Hvs 2020 Hvs Lodging Tax Report Usa

How Colorado Taxes Work Auto Dealers Dealr Tax

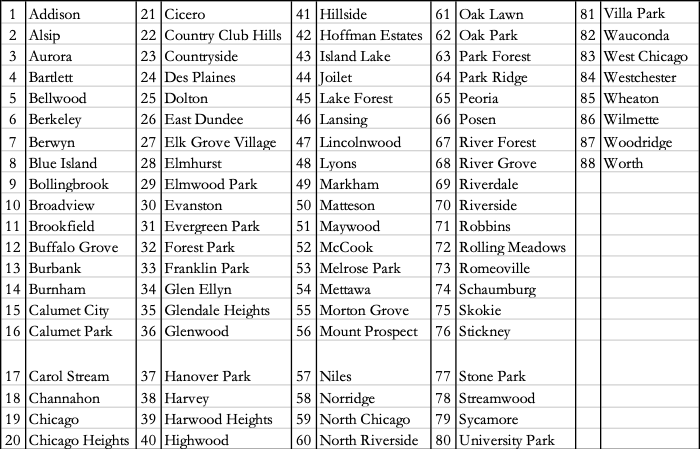

Illinois Sales Tax Guide For Businesses

H R Block 12104 E Mississippi Ave Aurora Co Yelp

Colorado Income Tax Calculator Smartasset

Estimated Effective Property Tax Rates 2009 2018 Selected Municipalities In Northeastern Illinois The Civic Federation